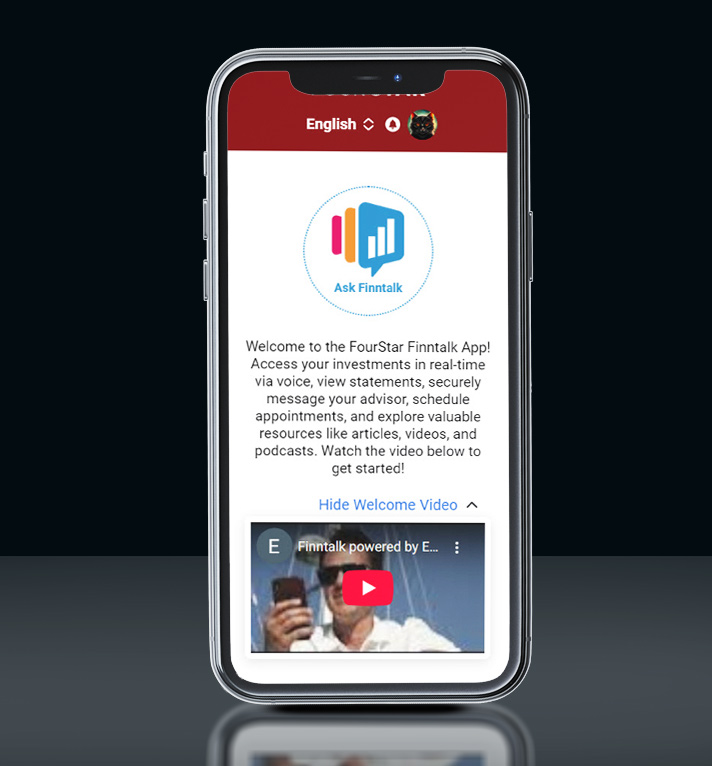

The FinnTalk App streamlines communication between clients and advisors, driving growth while ensuring compliance through transparent, real-time conversations.

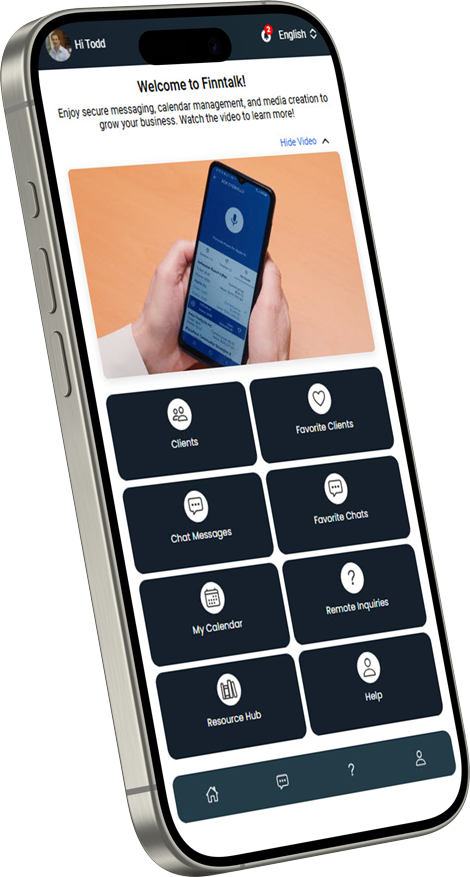

FinnTalk automates client responses, scheduling, document sharing, annual reviews, and onboarding—freeing advisors from time-consuming tasks so they can focus on business development and growth.

Regular client engagement boosts investment returns by 150 basis points, yet 81% of advisors lose clients due to lack of communication. FinnTalk ensures seamless, interactive contact—eliminating missed connections and strengthening client relationships.

FinnTalk’s Progressive Web App (PWA) bypasses app stores, ensuring faster deployment, greater control, and enhanced privacy—keeping your firm’s and clients’ data secure from Big Tech.

FinnTalk authenticates all client account information and inquiries, safeguarding both advisors and firms. Its comprehensive communication history acts as a defense against disputes, reducing the risk of costly arbitrations.

FinnTalk keeps all communications and documents compliant with regulatory standards, minimizing non-compliance risks. With built-in audit trails and secure data handling, advisors can confidently manage client relationships while protecting their firm from legal and regulatory challenges.

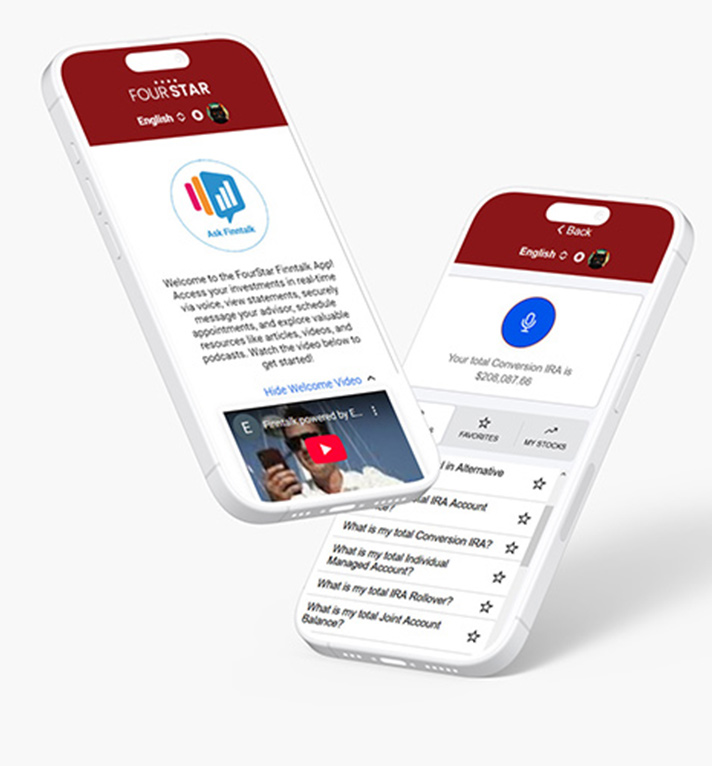

FinnTalk’s voice-activated app delivers real-time answers to portfolio questions. Clients can customize their most common inquiries, getting instant insights to their investment bottom line.

FinnTalk empowers clients with real-time access to portfolio information, reducing the need to contact their advisor for routine questions. With seamless, interactive communication, clients stay informed and confident, strengthening their advisor relationship without the frustration of waiting for answers.

Clients get secure, real-time access to their portfolio insights—no need to wait for advisor updates. This allows advisors to focus on portfolio growth.

FinnTalk’s Learning Center offers clients self-guided financial education, including a glossary of key terms, weekly podcasts, and advisor-led webinars—helping them make informed investment decisions with confidence.

FinnTalk enables firms to send documents digitally for quick client signatures This streamlined process speeds up approvals, enhances security, and keeps orders and important documents on track—saving time for both clients and advisors.

In 2024 firms have been fined over $2 billion in penalties since the SEC crackdown in 2021. FinnTalk helps to eliminate risky off-channel communications and avoid costly fines..

Automate routine tasks, allowing advisors to focus on growing assets.

Empower clients with transparent, immediate access to their financial information.

FinnTalk is a voice-activated app that connects financial advisors and clients securely. It ensures efficient, compliant communication—eliminating delays, misunderstandings, and off-channel violations while keeping clients informed and advisors proactive.

FinnTalk ensures compliance by securely capturing and documenting every client-advisor interaction within the platform. This eliminates the need for risky texting or other unrecorded methods, preventing "off-channel" infractions that can lead to costly fines. By channeling all communication through the app, FinnTalk generates a clear audit trail, which protects firms from legal disputes. The platform also aligns with the Fiduciary Rule and SEC Regulation Best Interest by ensuring that advisors maintain regular, documented contact with their clients.

FinnTalk empowers financial advisors by streamlining their workflow, reducing administrative burdens, and improving client relations. The platform automates scheduling, document sharing, onboarding new clients, and annual reviews, freeing up advisors to focus on prospecting new clients and managing existing ones. Additionally, FinnTalk provides advisors with insights into client inquiries, concerns, and behavioral usage, enabling them to provide more personalized and effective service. With the reduction of missed communication, the app helps in client satisfaction and retention. This increased efficiency enables business growth.

FinnTalk improves the client experience by providing real-time access to their financial custodial statements and simplifying their inquiries about their investments. Clients can use voice-activated or text-based features to get immediate answers and access an array of information. The platform also facilitates direct communication with their advisors, eliminating the frustration of phone tag. Clients can customize their most frequently asked questions, eliminating wait times. In addition to access and communication, FinnTalk also includes a "Learning Center" for clients to expand their financial literacy.

A PWA is a type of application delivered through the web that offers a user experience similar to a native mobile app, but without the need to download from an app store. FinnTalk chose PWA technology to ensure users can easily download the app and bypass the traditional app stores of Google and Apple. This way, FinnTalk ensures clients' data is not accessed through a third party and increases transparency with the firm and client.